About Us

you need to be sure there isn’t anything embarrassing hidden in the middle of Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet.

Contact Us

Chargeback Fraud: Definition, How It Works & Prevention

Chargeback fraud is one of the most pressing challenges in modern digital payments. For businesses, it doesn’t just result in lost revenue—it also leads to operational costs, damaged reputation, and strained relationships with payment processors. Understanding what chargeback fraud is, how it works, and the best ways to prevent it is essential for merchants operating in today’s online economy.

What Is Chargeback Fraud?

A chargeback occurs when a customer disputes a transaction with their bank or credit card issuer, leading to the reversal of funds. This mechanism is designed to protect consumers from unauthorized or unfair charges.

However, in the case of chargeback fraud (also called “friendly fraud”), the system is abused. A customer makes a legitimate purchase, receives the goods or services, but later disputes the transaction to get their money back—keeping both the product and the refund.

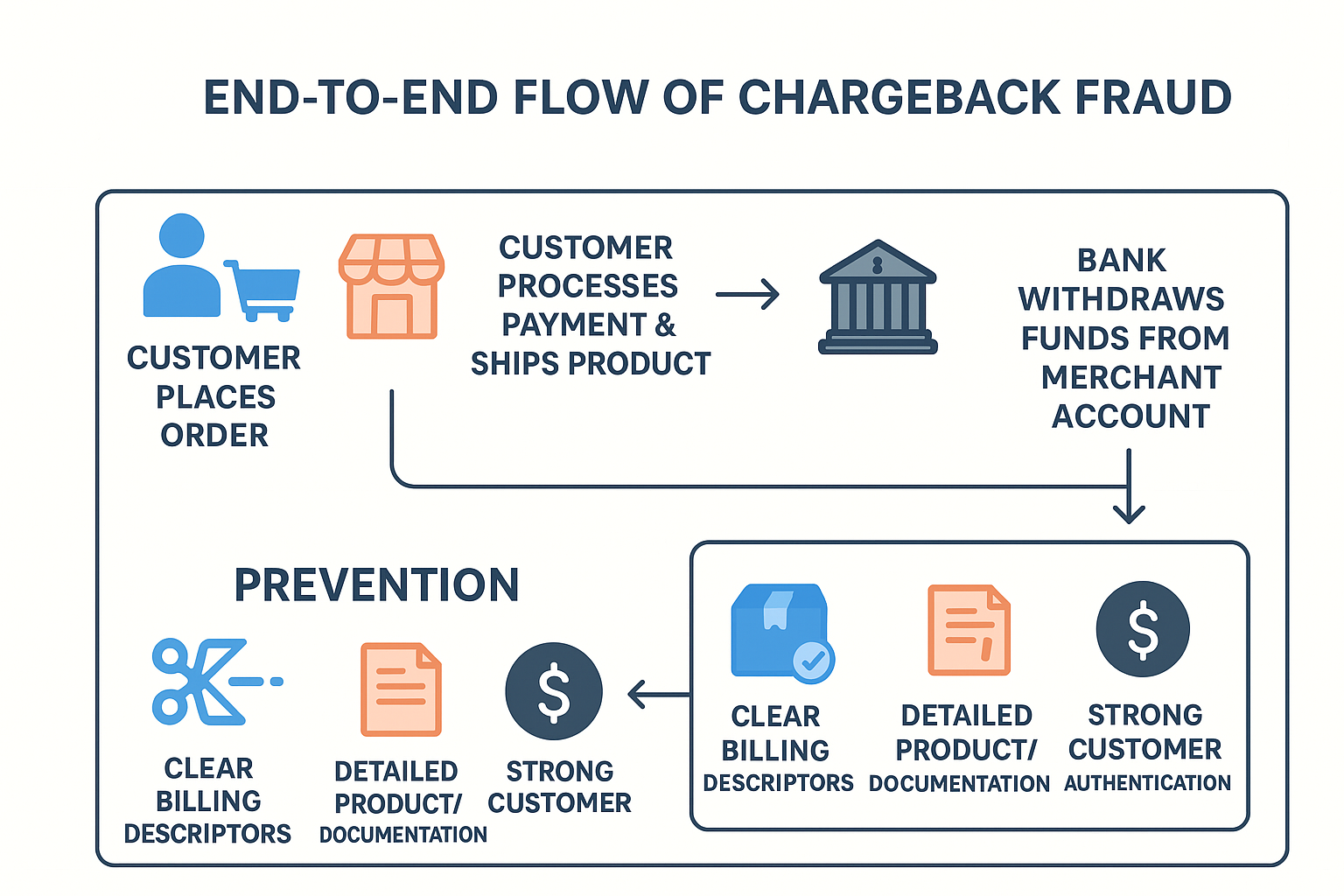

How Chargeback Fraud Works (Step-by-Step Flow)

Purchase Initiation

A customer places an order online using their credit or debit card.

The merchant processes the transaction and delivers the goods or services.

Receipt of Product/Service

The customer receives the order successfully.

No issues are raised directly with the merchant.

Dispute Filing

Instead of contacting the merchant, the customer files a complaint with their bank or card issuer, claiming one of the following:

The product wasn’t received.

The charge was unauthorized.

The product/service didn’t match the description.

Bank Investigation

The issuing bank temporarily withdraws the funds from the merchant’s account.

The bank investigates the dispute, often siding with the customer due to consumer protection bias.

Chargeback Approval

If the bank rules in favor of the customer, the funds are permanently reversed.

The merchant not only loses the sale but may also incur chargeback fees and risk higher processing costs.

Merchant Impact

Lost revenue + product.

Additional penalties from payment processors.

Potential damage to merchant’s credibility and long-term viability.

How to Prevent Chargeback Fraud

While it may not be possible to eliminate chargeback fraud completely, businesses can significantly reduce risk by implementing strong prevention measures:

Clear Billing Descriptors

Ensure the company name and transaction details appear clearly on customer statements.

Detailed Product/Service Documentation

Provide accurate descriptions, images, and policies to avoid disputes.

Strong Customer Authentication

Use multi-factor authentication (MFA) and fraud detection tools to prevent unauthorized transactions.

Delivery Confirmation & Tracking

Require signatures on delivery for high-value items.

Keep tracking numbers as proof of receipt.

Responsive Customer Service

Resolve disputes directly with customers before they escalate to chargebacks.

Chargeback Alerts & Monitoring Tools

Use services like Verifi or Ethoca to get notified of disputes early and respond proactively.

Maintain Evidence

Keep transaction logs, shipping records, and customer communication to contest fraudulent claims.

Chargeback fraud undermines trust in digital payments and can be costly for businesses. By understanding the flow of how it happens and implementing preventive strategies, merchants can protect themselves from unnecessary losses. Ultimately, balancing customer protection with merchant security is key to building a sustainable e-commerce ecosystem.